Assenagon Asset Management SA increased its holdings in Myriad Genetics, Inc. (NASDAQ:MYGN – Free Report) by 20.6% in the first quarter, according to its most recent Form 13F filed with the Securities & Exchange Commission. The institutional investor owned 110,985 shares of the company after purchasing an additional 18,948 shares during the period. Assenagon Asset Management SA owned 0.14% of Myriad Genetics at a value of $2,578,000 at the end of the most recent reporting period.

Assenagon Asset Management SA increased its holdings in Myriad Genetics, Inc. (NASDAQ:MYGN – Free Report) by 20.6% in the first quarter, according to its most recent Form 13F filed with the Securities & Exchange Commission. The institutional investor owned 110,985 shares of the company after purchasing an additional 18,948 shares during the period. Assenagon Asset Management SA owned 0.14% of Myriad Genetics at a value of $2,578,000 at the end of the most recent reporting period.

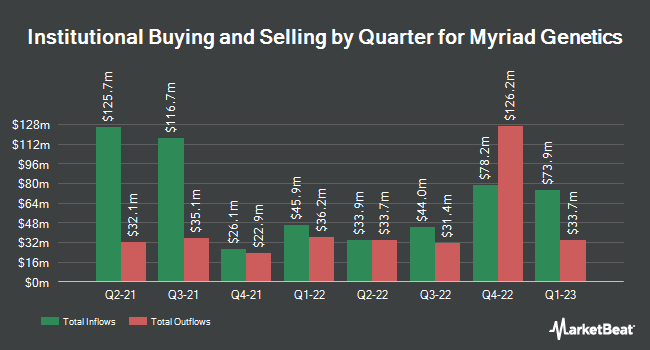

Several other large investors have also recently changed their stakes in the business. BlackRock Inc. increased its stake in Myriad Genetics stock by 0.8% in the first quarter. BlackRock Inc. now owns 14,797,829 shares of the company valued at $372,906,000 after purchasing an additional 113,042 shares in the recent quarter. Vanguard Group Inc. increased its stake in Myriad Genetics by 1.4% in the third quarter. Vanguard Group Inc. now owns 9,128,384 shares of the company valued at $174,170,000 after purchasing an additional 121,704 shares in the recent quarter. Wellington Management Group LLP increased its stake in Myriad Genetics shares by 17.8% in the first quarter. Wellington Management Group LLP now owns 5,096,235 shares of the company valued at $128,425,000 after purchasing an additional 770,460 shares in the recent quarter. State Street Corp increased its stake in Myriad Genetics stock by 14.5% in the second quarter. State Street Corp now owns 4,804,157 shares of the company valued at $87,292,000 after purchasing an additional 607,932 shares in the recent quarter. Finally, Glenview Capital Management LLC increased its stake in Myriad Genetics by 112.0% in the fourth quarter. Glenview Capital Management LLC now owns 3,097,768 shares of the company valued at $44,949,000 after purchasing an additional 1,636,284 shares in the recent quarter. Hedge funds and other institutional investors own 99.51% of the company’s shares.

Analysts set new price targets

Several stock analysts have recently valued MYGN stock. On Tuesday, May 23, Goldman Sachs upgraded shares of Myriad Genetics from a “sell” rating to a “buy” rating and raised the target price for the stock from $18.00 to $25.00. StockNews.com took coverage of Myriad Genetics stock in a research report on Thursday, May 18. They have issued a “hold” rating for the company. Three research analysts have rated the stock with a hold rating and two have issued a buy rating for the company. According to data from MarketBeat, the company has an average rating of “Hold” and a consensus price target of $26.60.

Myriad Genetics Price Performance

Shares of Myriad Genetics opened at $22.53 on Friday. Myriad Genetics, Inc. has a 1-year low of $13.92 and a 1-year high of $28.18. The company has a market cap of $1.84 billion, a PE ratio of -12.52, and a beta of 1.80. The company has a 50-day simple moving average of $21.70 and a two-hundred-day simple moving average of $20.69.

Myriad Genetics (NASDAQ:MYGN – Free Report) last reported earnings results on Wednesday, May 3. The company reported ($0.21) earnings per share (EPS) for the quarter, missing the ($0.19) consensus estimate by ($0.02). Myriad Genetics had a negative net margin of 21.05% and a negative return on equity of 7.42%. The company reported revenue of $181.20 million for the quarter, compared to the consensus estimate of $171.56 million. During the same prior-year quarter, the company earned ($0.14) earnings per share. The company’s revenue for the quarter increased 9.9% over the year-ago quarter. As a group, research analysts expect Myriad Genetics, Inc. to post -0.63 earnings per share for the current year.

Insider buying and selling at Myriad Genetics

In other news, Chief Executive Officer Daniel K. Spiegelman sold 8,638 shares of the company in a deal on Friday, June 2. The shares sold at an average price of $23.01, for a total value of $198,760.38. Following the completion of the sale, the director now directly owns 40,493 shares of the company, valued at approximately $931,743.93. The sale was disclosed in a filing with the SEC, available at this hyperlink. 2.00% of the shares are currently owned by company insiders.

A myriad of genetic profiles

(Free Report)

Myriad Genetics, Inc, a genetic testing and precision medicine company, develops genetic testing in the United States and internationally. The company offers molecular diagnostic tests for use in oncology and women’s and mental health applications. It also provides MyRisk Hereditary Cancer Test, a DNA sequencing test to evaluate the risks of hereditary cancers; BRACAnalysis CDx Germline Companion Diagnostic Test, a DNA sequencing test to help determine therapy for patients with metastatic breast, ovarian, metastatic pancreatic, or metastatic prostate cancer with deleterious or suspected germline BRCA variants; and MyChoice CDx Companion Diagnostic Test, a tumor test that determines homologous recombination deficiency status in patients with ovarian cancer.

to know more

Want to see which other hedge funds hold MYGN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Myriad Genetics, Inc. (NASDAQ:MYGN – Free Report).

This instant news alert was powered by MarketBeat’s narrative science technology and financial data to provide readers with the fastest and most accurate reports. This story was reviewed by the MarketBeat editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Myriad Genetics, you’ll want to hear this.

MarketBeat tracks Wall Street’s top-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are whispering to their clients to buy now before the broader market catches on…and Myriad Genetics wasn’t on the list.

While Myriad Genetics currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five titles here

Wondering when you can finally invest in SpaceX, StarLink or The Boring Company? Click the link below to learn when Elon Musk will finally allow these companies to IPO.

Get this free report

#Assenagon #Asset #Management #Strengthens #Holdings #Myriad #Genetics #NASDAQMYGN

Image Source : www.marketbeat.com