Allspring Global Investments Holdings LLC increased its holding in Fulgent Genetics, Inc. (NASDAQ:FLGT – Free Report) stock by 3,818.5% during the first quarter, according to its latest Form 13F filed with the Securities & Exchange Commission. The firm owned 63,010 shares of the company after acquiring an additional 61,402 shares during the quarter. Allspring Global Investments Holdings LLC owned approximately 0.21% of Fulgent Genetics valued at $1,967,000 at the end of the most recent quarter.

Allspring Global Investments Holdings LLC increased its holding in Fulgent Genetics, Inc. (NASDAQ:FLGT – Free Report) stock by 3,818.5% during the first quarter, according to its latest Form 13F filed with the Securities & Exchange Commission. The firm owned 63,010 shares of the company after acquiring an additional 61,402 shares during the quarter. Allspring Global Investments Holdings LLC owned approximately 0.21% of Fulgent Genetics valued at $1,967,000 at the end of the most recent quarter.

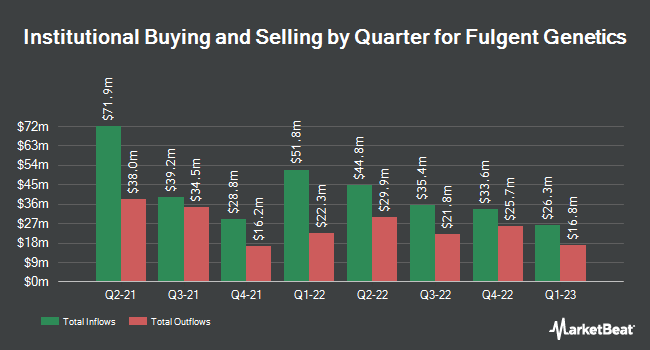

Other major investors have also made changes to their positions in the company. Geneos Wealth Management Inc. increased its stake in Fulgent Genetics stock by 416.8% during the first quarter. Geneos Wealth Management Inc. now owns 491 shares of the company valued at $30,000 after acquiring another 396 shares during the period. Covington Capital Management increased its stake in Fulgent Genetics stock by 133.3% during the third quarter. Covington Capital Management now owns 700 shares of the company valued at $27,000 after acquiring an additional 400 shares during the period. Lazard Asset Management LLC acquired a new position in Fulgent Genetics stock during the fourth quarter valued at $46,000. Nisa Investment Advisors LLC increased its stake in Fulgent Genetics by 829.3% during the fourth quarter. Nisa Investment Advisors LLC now owns 1,775 shares of the company valued at $53,000 after acquiring an additional 1,584 shares during the period. Finally, Point72 Middle East FZE acquired a new position in Fulgent Genetics stock during the fourth quarter valued at $79,000. Institutional investors and hedge funds own 45.09% of the company’s shares.

Fulgent Genetics trades up 1.3%

NASDAQ:FLGT opened at $36.75 on Friday. Fulgent Genetics, Inc. has a 1-year low of $28.27 and a 1-year high of $65.17. The company’s 50-day moving average price is $36.88, and its two-hundred-day moving average price is $33.44. The company has a market cap of $1.09 billion, a price/earnings ratio of -41.29, and a beta of 1.48.

Fulgent Genetics (NASDAQ:FLGT – Free Report) last released its quarterly earnings results on Friday, May 5. The company reported ($0.47) EPS for the quarter, topping analyst consensus estimates of ($0.68) by $0.21. The company reported revenue of $66.17 million for the quarter, compared with analyst estimates of $61.95 million. Fulgent Genetics had a negative return on equity of 1.05% and a negative net margin of 7.10%. Sell-side analysts expect Fulgent Genetics, Inc. to post -2.23 earnings per share for the current year.

Insider buying and selling

In other Fulgent Genetics news, insider Hanlin Gao sold 1,000 shares of the company in a deal on Friday, June 2. The stock sold at an average price of $40.30, for a total value of $40,300.00. Following the completion of the transaction, the insider now directly owns 914,391 shares of the company, valued at $36,849,957.30. The transaction was disclosed in a filing with the SEC, which can be accessed via the SEC’s website. In other news, insider Hanlin Gao sold 1,000 shares of Fulgent Genetics in a deal on Friday, June 2. The stock sold at an average price of $40.30, for a total transaction of $40,300.00. Following the completion of the transaction, the insider now directly owns 914,391 shares of the company, valued at approximately $36,849,957.30. The sale was disclosed in a filing with the Securities & Exchange Commission, accessible via this hyperlink. Additionally, CFO Paul Kim sold 1,403 shares of Fulgent Genetics in a deal on Friday, June 2. The stock sold at an average price of $40.30, for a total value of $56,540.90. As a result of the transaction, the chief financial officer now owns 228,890 shares of the company, valued at $9,224,267. Disclosure for this sale is available here. Over the past three months, insiders sold 3,836 shares of the company for $154,591. 31.76% of the shares are owned by corporate insiders.

The Wall Street analyst intervenes

Several stock analysts have recently released reports on the company. Piper Sandler raised Fulgent Genetics’ price target from $35.00 to $37.00 in a research note on Monday, May 8. StockNews.com began coverage of Fulgent Genetics in a research note on Thursday, May 18. They have issued a “hold” rating on the stock. Two analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat.com, Fulgent Genetics currently has an average rating of “Moderate Buy” and an average target price of $42.33.

Learn about Fulgent genetics

(Free Report)

Fulgent Genetics, Inc, together with its subsidiaries, provides diagnostic and therapeutic clinical development solutions to physicians and patients in the United States and internationally. The company’s clinical diagnostic solutions include molecular diagnostic tests; genetic testing; pathology laboratory testing and testing services, such as gastrointestinal pathology, dermatopathology, urological pathology, breast pathology, neuropathology, and hematopathology; cancer testing and testing services; and next generation sequencing services related to hereditary cancer, cardiovascular genetics, reproductive health and neurodegenerative genetics, as well as pharmacogenetic testing.

Featured Stories

This instant news alert was powered by MarketBeat’s narrative science technology and financial data to provide readers with the fastest and most accurate reports. This story was reviewed by the MarketBeat editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fulgent Genetics, you’ll want to hear this.

MarketBeat tracks Wall Street’s top-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are whispering to their clients to buy now before the broader market catches on…and Fulgent Genetics wasn’t on the list.

While Fulgent Genetics currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five titles here

Click the link below and we’ll send you MarketBeat’s list of the top seven retirement stocks and why they should be in your portfolio.

Get this free report

#Allspring #Global #Investments #Holdings #LLC #Acquires #Shares #Fulgent #Genetics #NASDAQFLGT

Image Source : www.marketbeat.com